France’s Recovery Plan: a balancing act between supply and demand

The French government presented on September 3rd its 100 billion euro "France Relance" recovery plan. This plan, worth 4% of France's GDP, is mainly focused on boosting the economy through supply factors (with a reduction in production taxes from 2021, representing 20% ??of the plan's expenditure), but also has an important demand-component. Let us examine here the main axes of this plan to put in perspective with the recovery plans of other European neighbours such as Germany.

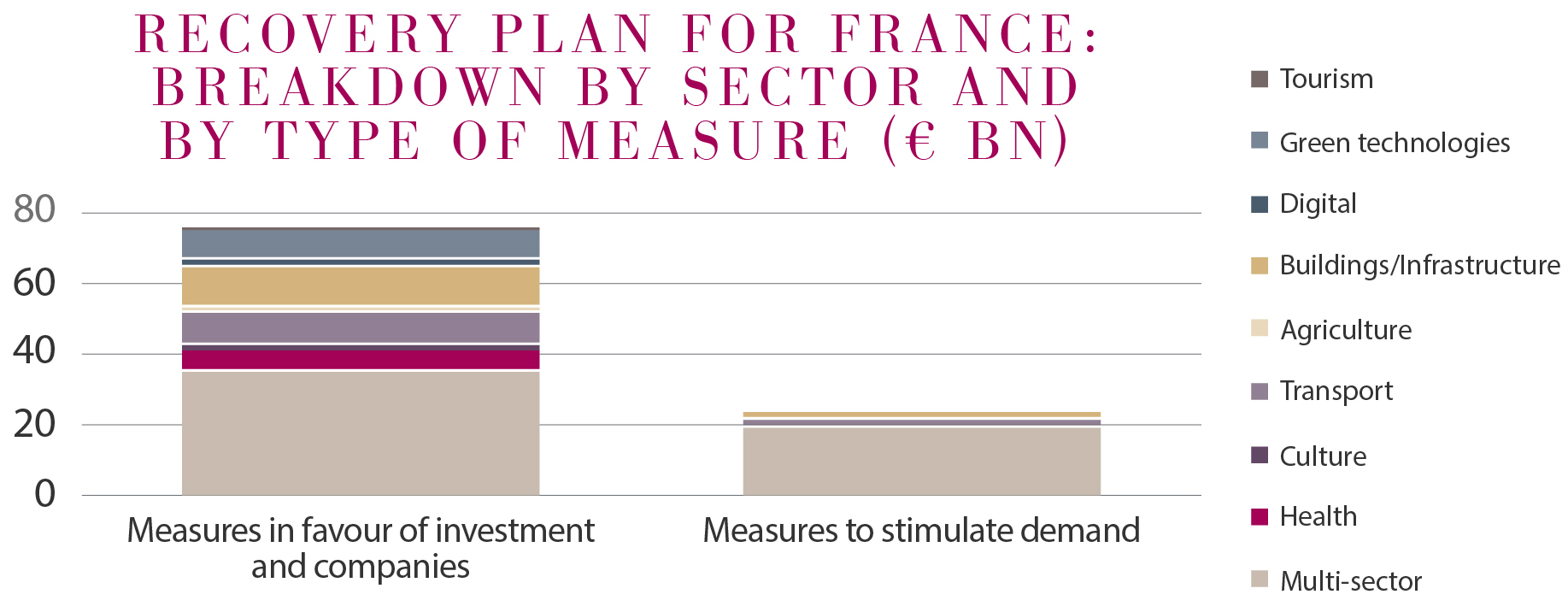

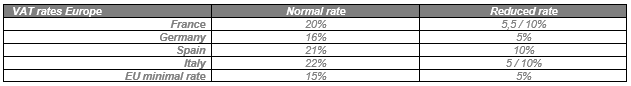

This choice to mainly focus on the supply-side (see graph 1) may at first glance seem all the more surprising as more than half of the German plan is devoted to stimulating demand through a reduction in the VAT rate to the minimum level applied in Europe (see table).

However, it is important to note that this plan follows numerous emergency measures already undertaken since March. A total of 470 billion euros was allocated to short-time working schemes (26 billion), support for sectors such as tourism and airlines most affected by the crisis (45 billion) and 300 billion worth of government-backed loans for non-financial companies. This has made it possible to, thus far, maintain employment and foster a beginning of a rebound in consumption post-lockdown.

Source: Plan France Relance, Indosuez Wealth Management, estimates

The choice of giving priority to investment and businesses could also be explained by the following elements:

First, the widely shared observation before COVID of a competitiveness gap between French and German production. This should not be limited to price competitiveness alone, but also taxation. As such, it is important to remember that taxation of French companies ranks second after Sweden among the highest taxes in the European Union (in 2018, according to the Montaigne Institute, the taxation of French production represented 10% of state tax revenues vs. 2% for Germany). This is particularly true for the industrial sector, which accounts for 14% of value added in France, but bears 20% of production taxes.

Secondly, due to exceptional constraints on consumption, French households have accumulated a significant level of precautionary savings during confinement, equivalent to the amount of the stimulus plan (i.e. 100 billion euros). If transformed, theoretically, these savings could ultimately support consumption. Compared with our European neighbours, the French savings ratio increased significantly by +5% in the first quarter of 2020 (to 19%) vs. +2% in Germany and + 4% on average in the EU. On the other hand, the savings rate is now well above the European average, which could lead to the conclusion that households are not constrained in their ability to consume and therefore a recovery based on the revival of purchasing power would not make sense. The natural catalyst for consumption and positive expectations of households is employment. The employment situation is not expected to improve for a few quarters, so the risk is that consumption will pick up sluggishly. Moreover, it is clear that since these accumulated savings are concentrated on higher incomes, it would be wrong assume that French households will resume consuming merely from spending excess savings. This prompts us to reconsider the German choice to lower the VAT rate, the least progressive tax and therefore more heavily affecting the most modest households.

Overall, the choice made by the French government through the "cohesion" component of the recovery plan is to continue to devote significant amounts (6.6 billion euros) to measures to support employment. The objective is ultimately to support production and employment in France directly, rather than supporting consumption, which could have the undesirable effect of increasing imports.

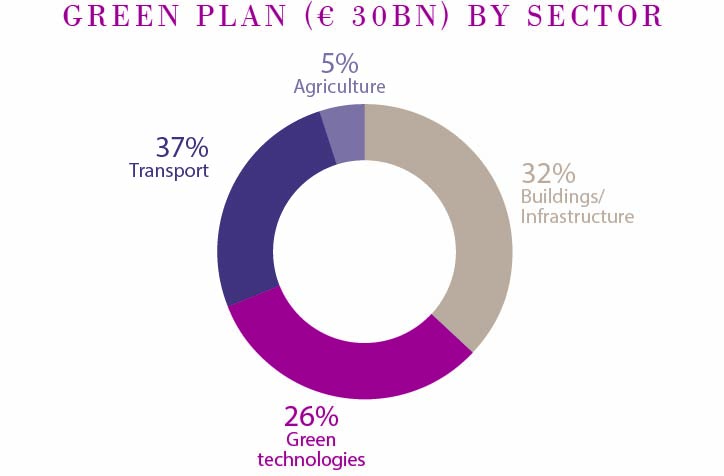

If we look at the new stimulus plan by sector, the plan is largely dedicated to the renovation of infrastructure and buildings (13% of the plan is dedicated to energy and thermal improvements) and the transport sector (12% of the total plan, with flagship measures on rail modernization, support for clean vehicles demand, aeronautical / space R&D, etc.). On the other hand, it provides less support for services, such as health (6%), culture (2%) and tourism (less than 1%). The common thread of these sectoral investments is of course going green (see graph), declared as a priority for the government, and this time in total consistency with the German plan and European ambitions. France will invest 30 billion in financing the ecological transition, a strong ambition (1.2% of GDP) and in line with Germany’s plan (worth 1.4%) but an amount that remains relatively modest compared to that announced by the US presidential hopeful Joe Biden (2 Trillion euros, or 9% of the GDP of the United States).

Source: Plan France Relance, Indosuez Wealth Management estimates

In the end, and like the European plan, this project is almost more of a transformation plan for the French economy than a recovery plan, as well as an opportunity to include measures already discussed before the pandemic. As indicated in the preface to the France Relance plan, the method consists "of transforming the crisis into an opportunity, by investing primarily in the most promising areas". Sector choices obviously seem pertinent, but one of the conditions for success will be to ensure the efficiency of the allocation of these investment envelopes. The schedule is very ambitious and the scale of the project will involve a very significant monitoring effort.

In terms of macroeconomic impact, with the support measures already taken this year, INSEE forecasts published on the 8th of September project a decline in GDP in 2020 of around 9%. The government estimates that this new plan should increase growth by 1.5 points from 2021, which should comfort or even improve our economic forecast of a 6.5% rebound in growth in 2021.

With regards to public finances, according to the last projet de loi de finance published at the end of July, the government had already revised its public deficit forecasts to 11.5% of GDP in 2020 and public debt to 121% of GDP (compared to 98.1% in 2019). These forecasts take into account 57 billion euros of the first 470 billion emergency plan as the 300 billion euros in government-backed loans (of which about 120 billion have already been granted) have no immediate impact on the budget.

Finally, for investors, this plan only confirms the structural appeal of long-term themes around health, digital, infrastructure and the environment despite their already strong performance this year.

Source: Commission européenne, Indosuez Wealth Management

September 11, 2020